Discover what Red Eléctrica is, what we do, and why we are the backbone of the electricity system in Spain and the ecological transition.

Red Eléctrica increased its investment in the transmission grid by 24% in the first six months of 2010 and profits increase by 13.6%

The investment of Red Eléctrica in the transmission grid during the first half of 2010 reached 318.3 million euros, representing an increase of 24% with respect to the same period last year. Similarly, the total investments of the Group were 20.5% higher, reaching 325.7 million euros.

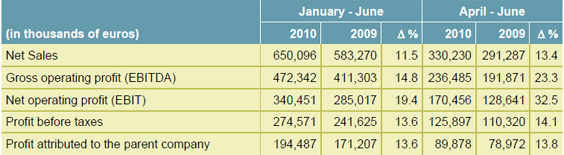

Additionally, the Red Eléctrica Group obtained a net profit of 195 million euros in the first half of the year, representing an increase of 13.6% with respect to the 171.2 million euros reported in the same period last year.

The gross operating result (EBITDA) rose to 472.3 million euros, 14.8% higher than in the first six months of 2009. This increase results from a growth of 11.5% in net turnover, which is basically due to a greater remunerated asset base and a moderate increase of 3.1% in operating costs.

Key financial figures

Relevant facts this quarter

Acquisition of Endesa, Unión Fenosa and Hidrocantábrico transmission assets. On 1 July, Red Eléctrica and Endesa Distribución signed an agreement by means of which and in accordance with Law 17/2007 of 4 July 2007, the latter has sold all of its owned transmission assets to Red Eléctrica. The agreement includes the in-service assets with remuneration rights in 2010, along with those assets under construction, whose commissioning is expected in 2010 and which shall grant remuneration rights in 2011. The price agreed for the in-service assets was 1,270 million euros and 142 million euros for assets under construction.

Additionally, the company has signed an agreement with Unión Fenosa Distribución by means of which Red Eléctrica acquires determined assets which are integrated in the transmission grid property of Unión Fenosa Distribución for a total price of 46.9 million euros.

Lastly, yesterday, 29 July, an agreement was reached whereby Hidrocantábrico Distribución has sold all its transmission assets to Red Eléctrica. The total price of this operation was 57.8 million euros.

Moody's and Standard & Poor's maintain the credit rating of Red Eléctrica. Following these operations, the risk evaluation agencies Moody's and Standard & Poor's have decided, in its annual review, to maintain the credit rating of Red Eléctrica at A2 and AA-, respectively. Both agencies emphasized the excellent history of the company when it comes to integrating assets it had previously acquired, its strategic position within the Spanish electricity system as well as the high liquidity which it enjoys, its high profitability and the predictability of its cash flows.