Discover what Red Eléctrica is, what we do, and why we are the backbone of the electricity system in Spain and the ecological transition.

Red Eléctrica Group profits grew to 390.2 million euros in 2010

Red Eléctrica de España has presented its consolidated results for 2010 with continued growth again this year and with the strong investment trends from previous financial years. Also noteworthy this year is the new transmission assets acquired from Endesa, Unión Fenosa and Hidrocantábrico.

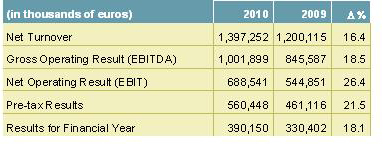

This trend is reflected in the profits of the Red Eléctrica Group for 2010 which grew to 390.2 million euros, representing an increase of 18% with respect to 2009, a financial year in which REE reported earnings of 330 million euros.

Similarly, investments in transmission grid developments rose 18% reaching 865.4 million euros compared to 735 million in 2009, which reflect the effort by the company to develop a grid which is more robust and better interconnected with neighbouring countries. Additionally, these figures respond to Red Eléctrica's strategic plan which has established an annual investment of 800 million euros and which is set to reach 4 billion euros in the next 5 years.

Regarding the total investment of the Group, the acquisition of assets from the electric companies has pushed the total up to just over 2,308.8 billion euros.

The gross operating result (EBITDA) grew 18.5% as a consequence of a 16.4% increase in net turnover, due fundamentally to an increased remunerated asset base and incomes linked to acquired transmission assets, as well as a lower increase in operating costs which grew just 12%.

These results shall be approved at the General Shareholder's Meeting called for by the Board of Directors of the company and to be held on 13 April. In addition, they shall approve the dividend of 1.8751 euros per share corresponding to the 2010 financial year, of which an interim dividend of 0.5882 euros was paid on 3 January, representing a payout of 65%.

Increase in the transmission assets of Red Eléctrica

During the month of July an agreement was signed by which Endesa Distribución, Unión Fenosa Distribución and Hidrocantábrico Distribución sold their transmission assets to Red Eléctrica, in compliance with that established in the Ninth Transitory Provision of Law 17/2007 of July 4. The sales contracts were fomalised in the final quarter of 2010 and the first few months of 2011.

After the acquisition of the assets, the credit rating agencies Moody's and Standard & Poor's maintained their credit rating of Red Eléctrica de España at A2 and AA- respectively.

In order to finance the purchase, Red Eléctrica took out a two-year bridging finance for 1.4 billion euros in the month of July. 80% of this operation was refinanced by two bond issues on the Euromarket, one in September for an amount of 500 million euros over a term of 6 years and the other in February 2011 for 600 million with a 7 year term.

Strategic Plan 2011-2015

Red Eléctrica has presented its strategic plan for the Group for the period 2011-2015, which contemplates investments over the next 5 years of 4 billion euros in the transmission grid, maintaining the volume of investments from the previous plan. This investment commitment will allow the integration of new renewable energy generation and will contribute to improving the competitiveness of the electricity system increasing the quality and security of supply.

Red Eléctrica have to complete the integration of the transmission assets acquired in 2010, especially those of the Balearic and Canary Islands. The objective of the renovation and improvement works on these facilities is to bring their standards of quality into line with those on the Spanish peninsula.

Similarly, Red Eléctrica will continue to be key in the integration of renewable energies into the Spanish electricity system and in addition will continue to drive demand-side management strategies with the aim of achieving a more efficient system.