For 40 years, we've been driving our country's economic and social progress. Four decades shaping Spain.

Profits of the Red Eléctrica Group reached €338 million in the first nine months of 2012

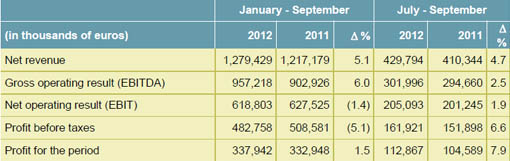

The Red Eléctrica Group recorded a profit of €338 million in the first nine months of 2012, representing a growth of 1.5% compared with the same period last year.

Net revenue was just over €1,279 million, an increase of 5.1% on the same period in 2011. This figure takes into account the effects, in the third quarter, of the measures enacted under Royal Decree Law 20/2012, issued on 13 July 2012, in addition to the exit from the Group of the Bolivian company Transportadora de Electricidad, S.A. (TDE).

The gross operating result (EBITDA) totalled €957 million, up 6% on the same period last year, owing to the growth in net revenue coupled with operating cost control.

Investments grew to €438.8 million. The bulk of this expenditure was earmarked for the development of the Spanish transmission grid (€417.8 million).

Net financial debt of the Red Eléctrica Group stands at just over €4,980.2 million which is 6.1% higher than the figure recorded at the end of the 2011 financial year.

In September a bond issue in the Euromarket amounting to €150 million and that matures in 2018 was carried out. The issue, subscribed to the amount of over €750 million, reinforces the position of liquidity of Red Eléctrica and allows progress to be made in covering the financial requirements for the next two years.

Key Figures

Relevant events

Credit ratings

On 15 October, the ratings agency Standard & Poor's downgraded the long-term and short-term ratings of Red Eléctrica Corporación, S.A. and Red Eléctrica de España, S.A.U., to 'BBB' and 'A-2' from 'A-' and 'A-2', respectively, maintaining a negative outlook. The agency has classified both the company's business profile and liquidity levels as "strong".

Similarly, on 18 October, the ratings agency Moody's confirmed the rating of Red Eléctrica de España, S.A.U. as 'Baa2' maintaining a negative outlook. The strong strategic position of Red Eléctrica, its solid financial profile and its adequate liquidity allow the Company to maintain this credit rating level.

Both the downgrading of the rating by Standard & Poor's and the maintaining of the rating by Moody's are as a consequence of the ratings recently given to the Kingdom of Spain. In both cases the credit rating of Red Eléctrica is one notch above that awarded to Spain.

World leader in the Utilities sector of the FTSE4Good sustainability Index

On 28 September, Red Eléctrica was ranked as the best company in sustainable and socially responsible policies in the Utilities sector, according to the FTSE4Good global Index which every six months evaluates the best environmental, social, and corporate governance practices.