Discover what Red Eléctrica is, what we do, and why we are the backbone of the electricity system in Spain and the ecological transition.

Creating economic value

During 2012, Red Eléctrica obtained not only sound economic results but also a significant improvement in its capital ratios and strengthening of its financial soundness.

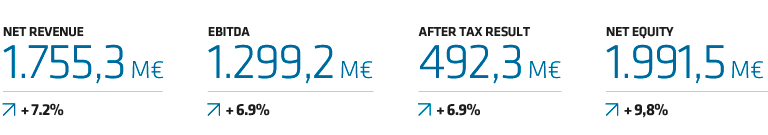

Evolution of the main financial highlights

| Net revenue | EBITDA | After tax result | Net equity |

|---|---|---|---|

| 1,755.3 M€ | 1,299.2 M€ | 492.3 M€ | 1,991.3 M€ |

| +7.2% | +6.9% | +6.9% | +9.8% |

More information:

Key performance indicators. Indicators and charts (Only Spanish version)

Investments carried out by the Group during the 2012 fiscal year reached 705.8 million euros. Of these investments, 671.6 million euros correspond to the development of the national transmission grid.

The net financial debt of the Red Eléctrica Group as at 31 December 2012 reached just over 4.872 billion euros. Regarding the interest rate, 87% of the net debt of the Group is fixed rate, whereas the remaining 13 % is variable rate.

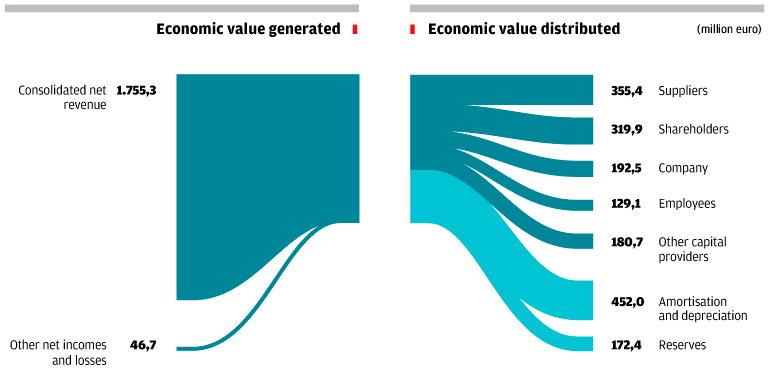

Economic value generated and distributed

This indicator, calculated according to GRI (Global Reporting Initiative) methodology, collates the generation of economic value of the Red Eléctrica Group and its distribution among the various stakeholders in 2012.

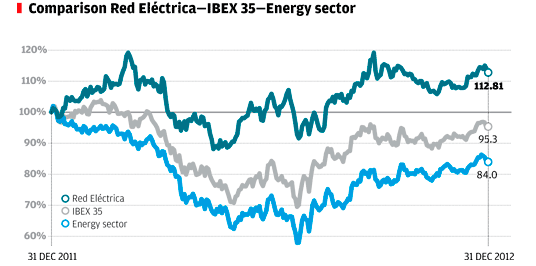

Stock market performance

Our country has suffered intensely during the sovereign debt crisis, with an accumulated decline of more than 25% at the beginning of the summer. Later, the decisive action of the European Central Bank and progress in economic matters by the European Union allowed it to recover, ending the year with a decline of 4.7%. The performance of Red Eléctrica shares has differed substantially from that of the IBEX 35. At year-end, it had a gain of 12.8%, very much in line with the average increase in European markets.

Dividend distribution: 2.3651 euros per share, with a payout of 65 %

Más información:

- Key performance indicators. Indicators and charts (Only Spanish version)

- Accionistas e inversores

Strategic Plan 2013-2017

In the coming years the company strategy will be developed with a focus on operational excellence and guidance to fulfill our commitments, which are none other than ensuring the quality and security of electricity supply and contribute to the efficiency and Spanish energy model sustainability.

Objectives 2013-2017

- Profits: 6-8% growth in average cumulative rate over the period.

- Dividend: dividend growth in line with profits (payout of 65%).

- Investment: 550-600 million euros a year.

More information:

![]() Corporate Responsibility Report 2012, pages 53-71 (PDF 1,6Mb)

Corporate Responsibility Report 2012, pages 53-71 (PDF 1,6Mb)