Discover what Red Eléctrica is, what we do, and why we are the backbone of the electricity system in Spain and the ecological transition.

Profit of the Red Eléctrica Group reached €159 million in the first quarter of 2014

- Investment rose to €94 million, of which 90% was earmarked for transmission grid development.

Red Eléctrica de España (REE) has posted a net profit of €158.7 million for the first quarter of 2014, a rise of 6.0% year-on-year. The Company today announced its results for this period in which investments amounted to €94 million.

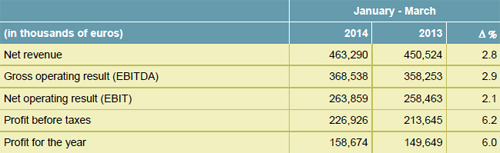

Net revenue for the first quarter of 2014 amounted to €463.3 million and its growth was 2.8% higher than the same period last year. In the first quarter, regulated incomes in Spain for transmission and system operation rose by 1.3% compared to March 2013 and include incomes from facilities commissioned in the previous year.

However, the increase in net revenue would have increased by 5.8% if the proportional part of the adjustments made in June as a result of the regulatory review of transmission activity had been included in the first quarter of 2013.

The increase in net revenue and the evolution of operating costs have allowed the gross operating result (EBITDA) to reach €368.5 million, up 2.9% on the previous year. Meanwhile, the net operating result (EBIT) was €263.9 million, representing an increase of 2.1% over the first quarter of 2013.

It is worth noting that the financial result improved by €8.2 million due to the lower average cost of debt and the lower average balance of the same.

The evolution of the aforementioned figures means that net profit stands at €158.7 million, showing an increase of 6% over the figure for the same period last year.

Investments for the quarter totalled €94 million, of which 90%, i.e. €84.9 million was earmarked for the development of the Spanish transmission grid.

Income statement

Commercial management of ADIF's fibre optic network

On 10 April, Red Eléctrica informed the CNMV (Spanish National Securities Market Commission) that the auction had concluded for the assignment and commercial management of the fibre optic network of ADIF (Administrator of Railway Infrastructures) for a 20-year period as the other bidder had failed to better the offer made by Red Eléctrica Internacional (REI).

On 25 April, the Board of Directors of ADIF formally awarded the assignment of this fibre optic network to Red Eléctrica Internacional. The transaction is also subject to approval by the antitrust authorities.

The total value of the deal amounts to €462 million, subject to compliance with the conditions in the information for bidders and to the final scope of the transaction. The telecommunications business, which has hitherto been managed by ADIF, has an estimated turnover of €72.4 million and an estimated EBITDA of €49.5 million.

Other relevant events in the first quarter

On 3 April, the Annual General Shareholders' Meeting was scheduled for 8 May 2014 at first call and for 9 May 2014 at second call. The agenda of the day includes the proposed dividend of €2.5422 per share, to be charged to the 2013 results. The dividend will be paid on 1 July 2014, minus the gross amount of €0.7237 per share paid out as an interim dividend on 2 January 2014.

Moreover, in March and the first few days of April, Red Eléctrica submitted to the regulator documentation audited by an independent third party accrediting the investment made in the renovation and upgrade of facilities that came into service prior to 1998 in order to request an increase in their residual life. This was done three months ahead of the schedule established in Royal Decree 1047/2013.

Audited information relating to the investment standards and the operation and maintenance of the transmission facilities was also submitted. The decision on the technical and economic parameters to be used for calculating the remuneration of the transmission activity shall be fixed before 15 July.

Red Eléctrica will then present its strategy for the period 2014-2018, probably in the second half of 2014.

The Press Office of Red Eléctrica publishes all written and visual information via the Twitter account @RevistaREE.

Also on Facebook through the account Revista Entrelíneas