Discover what Red Eléctrica is, what we do, and why we are the backbone of the electricity system in Spain and the ecological transition.

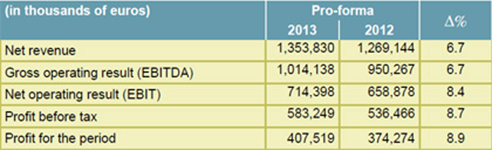

Recurring profit for the Red Eléctrica Group increased by 8.9% in the first nine months of the year reaching €408 million

These results reflect the homogeneous activity of the 2012 and 2013 financial years, that is, they eliminate non-recurring items of both years and the impacts of exceptional events that occurred in 2013, such as those derived from the regulatory measures in July, the balance sheet revaluation and the change in the scope of consolidation due to the expropriation of the Bolivian company Transportadora de Electricidad, S.A. (TDE) and the increased stake in Red Eléctrica del Sur, S.A. (REDESUR).

The investments of the company until September amounted to 380 million euros, in line with the targets set for the year. The development of the Spanish transmission grid represents the bulk of this investment, with 364 million euros.

Net revenue in the first nine months in homogenous terms rose to 1,354 million euros and its growth was 6.7% compared to the same period last year. This growth reflects the effect of a larger remunerated asset base resulting from assets put into service in 2012.

The gross operating result (EBITDA), also in homogenous terms, totalled 1,014 million euros , up 6.7% on the same period last year , due to increased revenue and a positive trend in operating costs, that between July and September remained almost constant compared to the third quarter of 2012.

On 1 July, €1.6887 per share was paid as a gross complementary dividend for the year 2012. In this way, the Company maintains in 2013 a dividend policy whereby it distributes to its shareholders 65% of its consolidated accounts.

Income statement in homogenous terms

Relevant events

- On 15 July, the Ministry for Industry issued a draft decree setting the methodology for calculating remuneration for electricity transmission and opening a dialogue process, as set out in Spanish legislation, between the regulator and industry players to make improvements to the proposed law.

- In this respect, on 26 July Red Eléctrica submitted its comments on the draft Royal Decree, highlighting the following points:

- The remuneration rate should ensure a reasonable return above agents’ cost of capital.

- The remunerated asset base should include all costs incurred.

- A system should be implemented to update net asset value.

- The residual life of assets should be determined based on their technical life.

- An appropriate remuneration mechanism for useful life extension should be designed.

- Suitable incentives should be introduced to remunerate availability of facilities, as well as plant construction and maintenance.

- In this vein, on 20 September the National Energy Commission released its comments on the Ministry of Industry’s proposals. Many of its opinions coincided with Red Eléctrica’s.

- On 12 September, Red Eléctrica was included in the DSI World Index for the eighth straight year. Inclusion in this index recognises the company’s place among the leaders in corporate social responsibility within the electricity sector worldwide.

- On 9 October 2013, the credit rating agency ‘Fitch’ affirmed Red Eléctrica Corporation, S.A.’s A- rating, negative outlook and assigned Red Eléctrica SAU an A- rating.

- Additionally, Red Eléctrica Corporación, S.A. informed Moody’s of its decision to end its contractual relationship in order to foster competition among credit rating agencies and encourage the rotation of credit agencies, as per the recommendations of Regulation (EU) 462/2013 of the European Parliament and the Council of 21 May 2013. From now on, Red Eléctrica has the solicited and participating credit rating agencies of Standard & Poor’s and Fitch.