Discover what Red Eléctrica is, what we do, and why we are the backbone of the electricity system in Spain and the ecological transition.

Red Eléctrica increases its investment in the transmission grid by 22.5%

The investment of Red Eléctrica in the transmission grid during the first nine months of 2010 reached 517 million euros, representing an increase of 22.5% with respect to the same period last year. Similarly, the total investments of the Group reached 527 million euros.

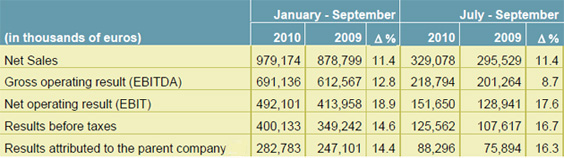

Additionally, the Red Eléctrica Group obtained an after-tax consolidated profit of 283 million euros from January to September, representing an increase of 14.4% with respect to the 247 million euros reported in the same period last year.

The gross operating result (EBITDA) rose to 691 million euros, 12.8% higher than in the same period of 2009. This increase results from a growth of 11.4% in net turnover, which is basically due to a greater remunerated asset base, the change in the CPI trend and, to a lesser extent, to higher income due to engineering and construction works for third parties, as well as to the containment of the operating costs, which increased 8.1%.

Key financial figures

Relevant facts

Acquisition of Endesa, Unión Fenosa and Hidrocantábrico transmission assets. This July, Red Eléctrica signed an agreement with Endesa Distribución, Unión Fenosa Distribución and Hidrocantábrico Distribución to acquire all of their owned transmission assets, in accordance with Law 17/2007 of 4 July.

The price agreed for the transaction with Endesa rose to 1.27 billion euros, corresponding to the in-service assets, and an additional 142 million euros for the assets under construction. Similarly, the transaction carried out with Gas Natural-Fenosa and Hidrocantábrico rose to 46.9 and 57.8 million euros respectively.

Red Eléctrica will consolidate the assets acquired once it is approved by the Ministry of Industry and the corresponding autonomous communities. In the case of the Endesa assets, the consolidation will take effect from 28 July, the effective date of the transaction, which an advance payment for the sum of 1 billion euros was made.

Red Eléctrica credit rating. Following these acquisition operations, the risk evaluation agencies Moody's and Standard & Poor's have maintained, in its annual review, Red Eléctrica's credit rating at A2 and AA-, respectively.

Financing and bond issue. For the acquisition of the transmission assets, Red Eléctrica has taken out bridging finance over two years with seven financial institutions for the sum of 1.4 billion euros.

Additionally, and to refinance a part of this bridging finance, in September the company carried out a bond issue on the Euromarket for a total of 500 million euros, whose payment and closing took place on 7 October. This issue, with a 6 years maturity, has an annual coupon of 3.5% and an issue price of 99.374%.