For 40 years, we've been driving our country's economic and social progress. Four decades shaping Spain.

Profits of the Red Eléctrica Group reached €225 million in the first half of 2012

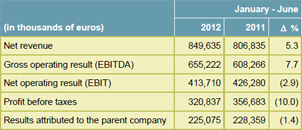

The Red Eléctrica Group recorded a profit of €225.1 million in the first half of 2012, down 1.4% on the same period last year.

This figure takes into account the effects of Article 39 of Royal Decree Law (RDL) 20/2012, issued on 13 July 2012, whose application has resulted in a €45 million decrease in transmission remuneration for 2012. Also taken into account in this figure is the expropriation of the Bolivian company Transportadora de Electricidad, S.A. (TDE) and the application of conservative valuation criteria for certain auxiliary assets.

Net revenue for the first half of 2012 amounted to €849.6 million, representing year-on-year growth of 5.3%. Gross operating result (EBITDA) totalled €655.2 million, up 7.7% on the same period last year, owing to the growth in net revenue coupled with operating cost control.

Investments reached €285 million in the first half of 2012, down 19% on the same period of 2011. The majority of this investment, some €272.4 million, was earmarked for the development of the Spanish transmission grid.

Net financial debt of the Red Eléctrica Group was 1.6% lower than the figure recorded at the end of the 2011 financial year.

In June 2012, the Group arranged a €175 million loan from the European Investment Bank (EIB) to finance the Spanish section of the Spain-France electricity interconnection. In addition, between May and July the Group also secured various long-term financing operations amounting to €450 million. These operations are geared towards closing the refinancing of debt maturities of the Group over the next three years.

Key figures

Relevant Events

Nationalisation of TDE

On 1 May 2012 the Bolivian government nationalised the company Transportadora de Electricidad, S.A. (TDE), a subsidiary of Red Eléctrica. To date, an agreement on a fair price for the indemnisation to be paid to Red Eléctrica has yet to be determined.

Credit rating downgrade

In May 2012, the rating agency Standard & Poor's downgraded the short and long-term ratings for Red Eléctrica Corporación, S.A. and Red Eléctrica de España, S.A.U, from 'A+' and 'A-1' to 'A-' and 'A-2', respectively. Likewise, in June, Moody's lowered the 'A2' long-term rating held by Red Eléctrica de España and its subsidiaries to 'Baa2'.

These modifications are a consequence of the downgrading of the credit rating of the Kingdom of Spain. This has, based on its strong strategic position and solid financial profile in both aforementioned cases, allowed Red Eléctrica's rating to be one level above Spain's sovereign rating.

Annual General Shareholders' Meeting

The Annual General Shareholders' Meeting held on 19 April 2012 approved the distribution of a dividend of €2.2124 per share. In this respect, a payment of €1.536 per share was made on 2 July regarding the gross complementary dividend corresponding to the 2011 fiscal year.

The shareholders also approved the re-election of José Folgado as Executive Board Director. Subsequently, the Board of Directors renewed the membership of the Audit Committee and the Corporate Governance and Responsibility Committee. Both committees are primarily comprised of independent directors.