Discover what Red Eléctrica is, what we do, and why we are the backbone of the electricity system in Spain and the ecological transition.

Profit for the year of the Red Eléctrica Group at the close of September reached €550.8 million

- This figure represents an increase of 8.64% compared to the same period in 2020, mainly due to the good performance of Hispasat.

- Investment in the development of the national transmission grid totalled €232.4 million, 7.3% more than in the previous year due to the promotion of key projects for the ecological transition such as the development of interconnections or projects for the evacuation of renewable energy.

- The Group has updated its green finance framework to bring it into line with the European Union’s Taxonomy Regulation, thus reinforcing its leadership in sustainability.

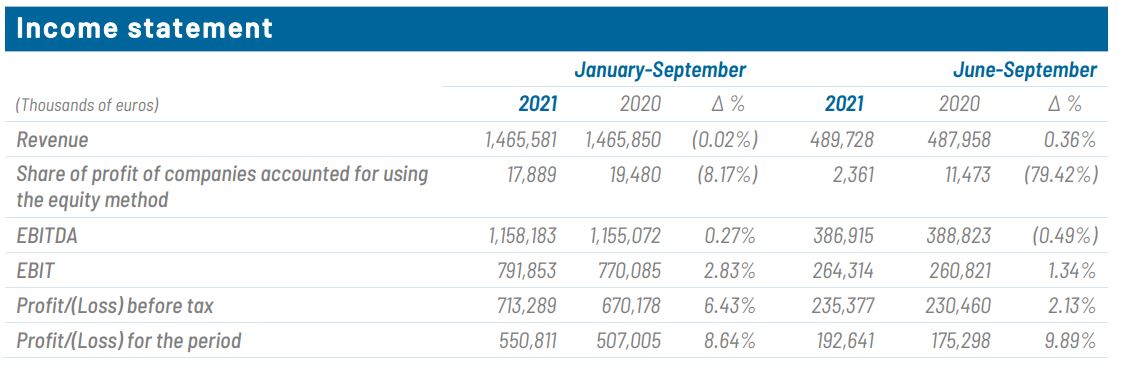

The Red Eléctrica Group today announced the financial information relating to the first nine months of 2021, a period in which the Company's profit totalled 550.8 million euros. This represents an increase of 8.64% compared to the same period last year, when it stood at 507 million euros, mainly due to the improved financial results of all the Group's activities and the greater contribution of the satellite business as a whole.

Revenue amounted to €1,465.5 million in the third quarter, in line with the same period of the previous year. This figure is marked by the fall in revenue from the regulated business in Spain - due to the application of the new remuneration parameters - which has been offset by an increase in revenue in the satellite business of €16.8 million, mainly due to the acquisition by Hispasat of the signal management and transmission business of Media Networks Latin America, which has led to a net contribution to the Group's consolidated revenues of €8.6 million, as well as to higher organic growth and a greater contribution from Hisdesat.

On the other hand, gross operating result (EBITDA) reached €1,158.2 million, slightly higher (0.3%) than that obtained in the first nine months of 2020.

The Group’s net financial debt as at 30 September stood at €5,998.4 million compared to €6,113.3 million reported in December 2020, thus lowering the Group’s cost of debt from 1.82% in 2020 to 1.53% in 2021.

Investments to advance in the ecological transition

Of the investments made by the Group from January to September, particularly noteworthy is the volume allocated to the management and operation of electricity infrastructure in Spain, which amounted to €249.1 million, 8.7% more than in the same period of the previous year. Of this, 232.4 million euros was earmarked for the development of the national electricity transmission grid, an increase of 7.3% compared to the first nine months of 2020. Thanks to this investment drive, significant progress has been made in actions that are key to the success of the green transition, including projects aimed at evacuating renewable energy and increasing installed capacity as well as projects focused on energy storage and electricity interconnections.

Among the latter is the new link that will connect Ibiza and Formentera. This interconnection project between the two islands has made significant progress in recent months. Specifically, in August it received a favourable environmental impact statement, and, in September, the administrative authorisation permits for construction and the declaration of public utility from the Directorate General for Energy Policy and Mines of the Ministry for Ecological Transition and the Demographic Challenge.

Similarly, at the end of July, the Salto de Chira pumped storage hydroelectric power station received a favourable environmental impact statement. This power station will be a fundamental tool for bolstering the security of the electricity system on the island of Gran Canaria and will enable the integration of renewable energy, thus reducing CO2 emissions.

Meanwhile, investments in the satellite business have increased by 39.5%.

Total investments made by the Group up to the end of the third quarter amounted to €349.1 million. Investments made in the previous year totalled €676.8 million euros due to the acquisition of 50%of the share capital of the Brazilian company Argo (374.3 million euros paid in March 2020).

Leadership in sustainability

In the last quarter, Red Eléctrica has continued to strengthen its leadership in sustainability with tangible milestones. Specifically, the Group has updated its green finance framework to bring it into line with the European Union’s Taxonomy Regulation, thus becoming one of the first companies in the world dedicated to the transmission of electricity and system operation to submit the environmental sustainability of its activity for review. This adaptation bolsters Red Eléctrica's leadership in sustainability, a key element in the Group's strategy to promote the transition towards a greener, fairer, more inclusive and diverse development.

This commitment to diversity has also enabled the Group to position itself in the Refinitiv Diversity and Inclusion Index 2021 as the most diverse and inclusive Spanish company and the second in the world in the electricity sector. In addition, this index, which recognises the 100 companies worldwide with the best level of performance in terms of diversity and transparency, ranks Red Eléctrica in 18th place in its world ranking. This recognition acknowledges the efforts made by the Company to promote gender equality, a cross-cutting axis in the Group.

Similarly, as at 30 September, 32% of the Group's financing incorporates ESG criteria.