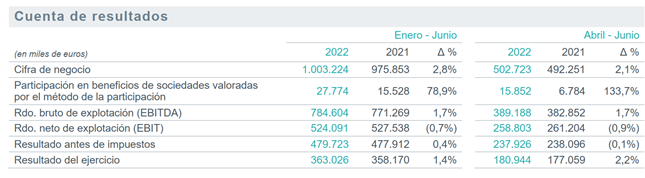

- This result represents an increase of 1.4% compared to that recorded in the same period in 2021.

- The TSO accelerates its investment pace following the approval of the Transmission Grid Planning, with a total investment in Spain which is 10.8% higher than that recorded in the first half of 2021.

Redeia (formerly the Red Eléctrica Group) has posted a net profit of €363 million for the first half of 2022, 1.4% more than in the same period in 2021. This result, in line with the Group's forecasts, is largely linked to the good performance of the electricity transmission operations abroad, which reported a net result of €31.9 million.

Total revenues (revenue and profit of the investees) totalled €1,031 million, a figure that is 4% higher than that recorded in the first half of 2021.

All businesses have shown positive growth, although the electricity transmission business abroad is particularly noteworthy, specifically due to the update of revenues and organic growth in Chile and Peru, the improvement in the currency exchange rate and the good performance of Argo's activity in Brazil, driven by the commissioning of the Argo II and Argo III projects and the acquisition of Argo IV (Rialma).

For its part, revenues generated by the satellite business improved by 14.7% due to higher sales, the impact of the acquisitions made in 2021 in Peru, and the currency exchange rate.

EBITDA amounted to €784.6 million, up 1.7% on the first six months of the previous year.

Redeia's efforts to improve efficiency and the higher results of the electricity transmission business abroad as well as that of the satellite and fibre optic businesses contributed to this figure. Net operating profit (EBIT) totalled €524.1 million, down 0.7% on the same period last previous year.

Net financial debt closed the month of June at €4,374.7 million, 22.5% lower than in the previous year (than at the end of 2021). This sharp decrease is the result of the sale of 49% of Reintel’s shares to KKR, which will enable the Company to strengthen its equity to meet the challenges of the green transition. Additionally, Redeia reduced the average cost of its financial debt from 1.53% in the first half of 2021 to 1.46% in 2022.

These results reinforce the Company's solid financial position. On 26 April, the credit rating agency Standard & Poor's confirmed Redeia's 'A-' rating. As at 30 June, 38.4% of the Company’s financing incorporated ESG criteria.

With regard to the dividend payout, on 1 July, Redeia paid a final dividend for 2021 of 0.7273 euros per share. Thus, the total dividend paid against 2021 profits amounts to 1 euro per share, as provided for in the current Strategic Plan.

Boost to investments

The Group's investments in this first half of the year recorded an increase of 8.2%, reaching €273.4 million.

Investment earmarked for the development of the transmission grid in Spain totalled €202.8 million, 10.8% higher than in the first half of 2021. Thus, following the approval of the 2021-2026 Transmission Grid Planning, the Company is strengthening and accelerating its rate of investment.

Specifically, this investment amount is explained by the progress made in strategic projects such as the Lanzarote-Fuerteventura interconnection (which already has received the authorisation to begin operation), the Salto de Chira energy storage project in Gran Canaria (already under construction) or the good level of progress made regarding the execution of the Ibiza-Formentera interconnection (scheduled work for the first phase of the link has already been completed). Investments have also been made in grid meshing projects, such as the Sabinal axis in Gran Canaria and the Madrid East Plan axis.

The investment programme also included the amounts linked to the management and operation of electricity infrastructure abroad. The investment made in Peru in the Tesur 4 project, which is expected to be commissioned at the end of this year, has also been increased. Redinter, the Group's international subsidiary, is also working towards completing the Redenor and Redenor 2 projects in Chile. The investment associated with these projects amounts to €15.7 million.

Regarding the telecommunications business, investment in fibre optics in the first half of the year was slightly higher than in the previous year. In the satellite business, where investments totalled €33.1 million, progress continues to be made in the construction of the new Amazonas Nexus satellite, which is scheduled for launch early next year.

In addition, €19.1 million have been allocated to other investments, including infrastructure for the Group and investments carried out by Elewit, Redeia's technological platform.

Main highlights

Among the most significant milestones in the first half of the year, noteworthy is that on 31 January, Argo acquired the Brazilian electricity infrastructure company Rialma Transmissora de Energia III S.A. for a total of 389 million Brazilian reais, which has meant an investment for Redeia of 50%, in accordance with its shareholding in ARGO, equivalent to €32.4 million. This transaction will add 322 kilometres of 500 kV line circuit to the total assets it already manages in Brazil.

On the other hand, in March the Council of Ministers approved the Electricity Transmission Grid Development Plan for the period 2021-2026, which will enable the massive integration of renewable generation (to reach 67% penetration by 2026), the development of international cross-border connections and interconnections between non-mainland territories, and also maintain and improve the security of supply. The actions contemplated in this Plan, which is binding for Red Eléctrica, will involve an estimated investment of €6,964 million and will be essential in order to achieve the decarbonisation targets.

That same month Hispasat reached an agreement to acquire 100% of Axess Networks Solutions Holding, S.L.U., a transaction that values Axess’ equity at 96 million US dollars. This investment is part of the Company's/ Hispasat’s roadmap aimed at acquiring a greater presence in the satellite communications value chain. The investment will become effective once the relevant authorisations have been obtained from regulatory authorities.

Lastly, on 29 June, the sale of the 49% non-controlling shareholding in Reintel to KKR was completed for €995.6 million. The addition of KKR to Reintel’s shareholder structure will facilitate the achievement of the objectives set by the fibre-optic subsidiary and will provide it with greater strength in the Spanish communications transmission market.

Leadership in sustainability

During this period, Redeia has continued to reap recognition for its commitment to sustainability. On 14 July, the credit rating agency Standard & Poor's issued a report evaluating Redeia's ESG performance, awarding the Group an overall score of 82 out of 100, thus demonstrating that Redeia is a key player in the energy/green transition and that its contribution is fundamental to helping Spain meet its 2030 renewable energy generation and emissions reduction targets.